Home Owner Insurance (HO) or Dwelling Policy (DP) are the two most common types of home insurance.

Depending on whether it's owner occupied (HO) or tenant occupied (DP), your type of insurance coverage will vary.

For example, HO includes personal property protection while DP usually does not include personal property protection.

Section 1 - Property Insurance

Coverage A – Dwelling

Covers the reconstruction value of the dwelling (excluding the land), amount limited to the policy's limit. It covers the replacement cost of the building.

Coverage B - Other Structures

Covers structures on the lot but not connected to the main building. Usually limited to 10% to 20% of coverage A.

Coverage C – Personal Property

Personal property is covered, usually comes with 50% of coverage A.

Coverage D – Loss of Use/Additional Living Expenses

Covers additional living expenses (i.e. rent expenses) in the event of insured cannot reside at residence due to loss.

Additional insurance

Covers expenses such as clutter removal, reasonable repairs, tree and shrub damage due to certain specified hazards (excluding the most common causes of damage, wind and ice), property relocation to a new home, credit card/identity theft expenses, Damage assessment, collapse, landlord's furniture and additions to some buildings. These require additional insurance coverage.

Section 2 - Liability

Coverage E – Personal Liability

Liability and medical expenses covering injury and property damage for other than the insured.

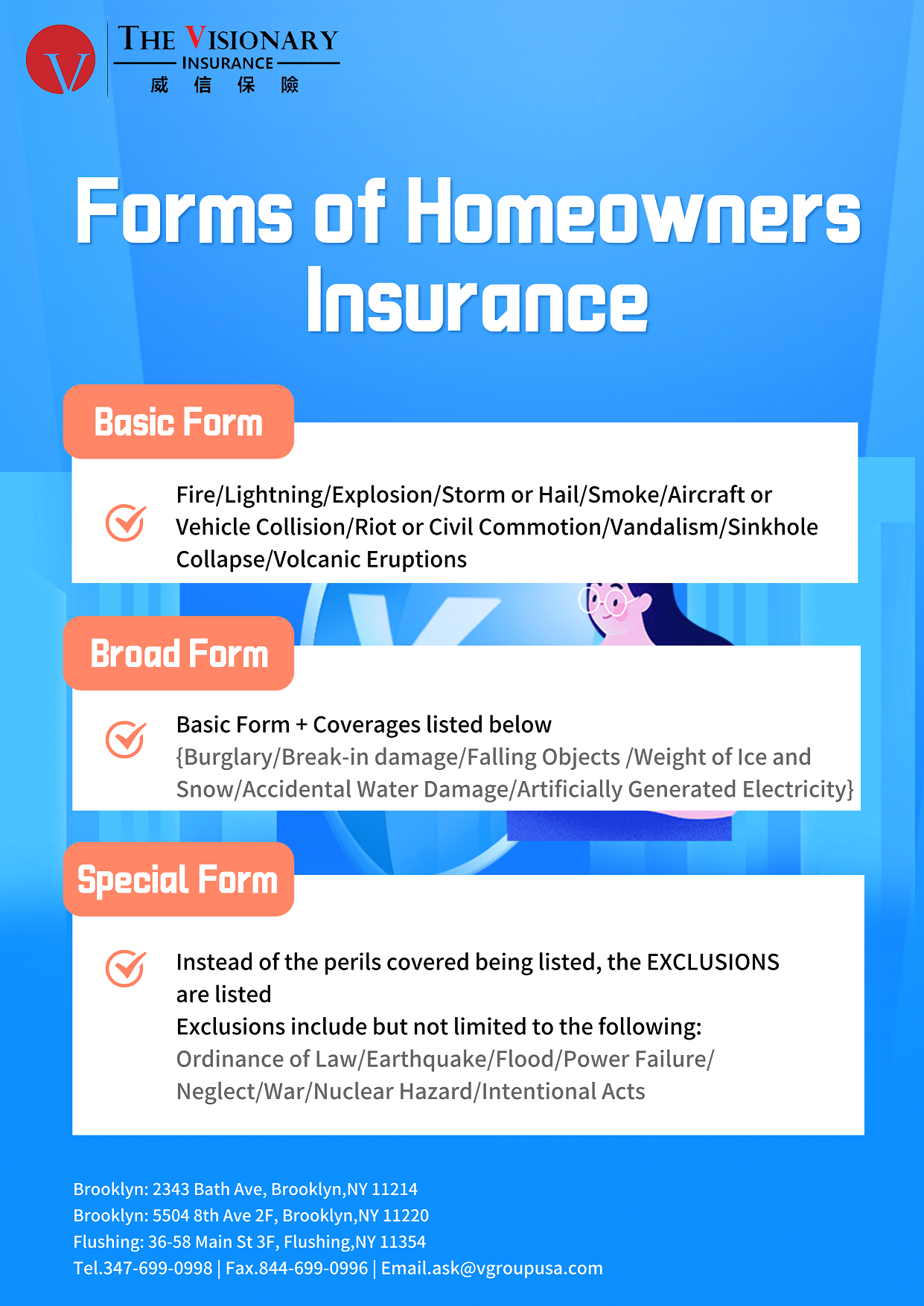

Homeowner's insurance come with different forms of protection. The higher the form, better the protection and the higher the cost.

Other types of home insurance include the following:

HO-5 Comprehensive coverage: Broader coverage than HO-3, which is primarily used for luxury home insurance.

HO-4 Renters Insurance: Protects the renter's personal property and liability.

HO-6 Condominium Insurance: This insurance is designed to protect the personal property and liability of condo and co-op owners.

HO-7 Mobile Home Insurance: For mobile home owners.

HO-8 Modified Form: If the market price of a property is less than the rebuild value. HO8 allows homeowners to insure at market rates below the rebuild price.